The Saudi Arabian Oil Company known as Saudi Aramco is Saudi Arabia’s national petroleum and natural gas company. Based in Dhahran, Saudi Arabia, it is one of the largest companies in the world on the basis of revenue, and according to accounts of the Bloomberg News, it is the most profitable company in the world.

Saudi Arabia has finally approved the much-awaited listing of shares in the state oil giant Saudi Aramco on its domestic exchange, Tadawul, which is expected before year-end. The initial public offering slated to be the largest and expected to eclipse that of Alibaba’s listing has intrigued global investors, banks and financial advisers. On Sunday, the oil behemoth offered some clarity on its mammoth IPO exercise.

HERE’S ALL YOU NEED TO KNOW ABOUT IT!

1The most profitable company in the world

One would assume that the most profitable company in the world would be either Apple or Google. However, those two don’t even come close to the competition. The answer is Saudi Arabia’s state oil company, Aramco. In 2018, Saudi Aramco made 111 billion dollars in profit. Apple is a far off second-most profitable company at a $60 billion that year.

2The history behind the company

The Rockefeller family’s Standard Oil Company found oil in Saudi Arabia in 1938 and the venture became known as the Arabia American Oil Company. However, by 1972, the United States could no longer pump more oil to meet rising demand and thus decided to import oil from Saudi Arabia. Saudi’s continued to provide the ever-growing needs of the United States. Taking note of this demand, the oil minister at the time, Zaki Yamani and other oil-producing countries in the Middle East that were already united under OPEC, unilaterally raised the price of the oil. They did this in conjunction with the Arab-Israeli War of 1973, along with an oil embargo, and the effect was immediate. The price of oil skyrocketed, and in fact caused a recession in the United States while also helping oil companies make a lot more money from this, including Aramco. The Saudis put all this cash into their own palaces and their own country while also using it to buy the company from the Americans. In 1988, the Saudis eventually renamed the company to Saudi Aramco.

3 Company size and scale

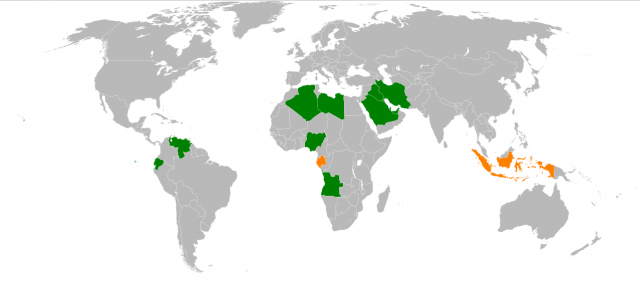

The company produces, refines and exports oil from Saudi Arabia, but has refining operations across the globe. With 76,000 employees in 2018, Aramco has energy industry operations, research facilities, and offices scattered across the globe, in Asia, Europe, and the Americas. It has country offices in Beijing, New Delhi, Singapore, New York, London, Houston and elsewhere. Aramco’s US oil refining subsidiary, Motiva Enterprises, owns Port Arthur, Texas, refinery which is the largest in the United States and in 2017 it announced plans for $18 billion in investments in its operations in the Americas over five years. Aramco is also expanding its oil refining capacity particularly in rapidly growing countries such as China and India. In 2018 Aramco had a net refining capacity of 3.1 million barrels per day.

4Production and Export

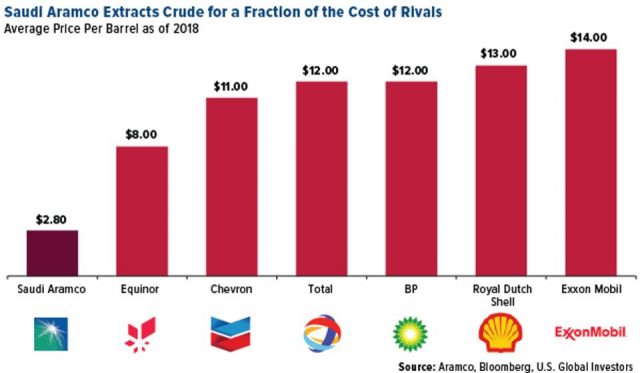

In 2018, Aramco produced 10.3 million barrels of crude oil per day, touted to be the lowest cost in the world to produce crude, at $2.80 a barrel, according to company documents. It also produced 1.1 million barrels of natural gas liquids and 8.9 billion standard cubic feet per day of natural gas. Almost three-quarters of Aramco’s crude exports, about 5.2 million barrels per day, were delivered to customers in Asia last year, where Aramco believes demand will grow faster than elsewhere in the world. Its crude deliveries to North America reached more than 1 million barrels per day last year.

5Reasons for going Public

The Crown Prince Mohammed bin Salman wants to diversify the Saudi economy away from oil. Deciding to end the country’s “oil addiction” to ensure it was no longer at the mercy of the volatility of commodity pricing, he announced plans for an Aramco IPO in 2016.

Another reason for this move is that Saudi Arabia is building a futuristic mega-city 33 times the size of New York City, from scratch. Saudi officials describe it as “the world’s most ambitious project.” Called Neom, it’s a planned 16-borough city on the Red Sea coast in the northwestern Saudi province of Tabuk. Crown prince Mohammed bin Salman told Bloomberg in October 2018 that Neom will be completed in 2025, and phase one is nearing completion. Its goal is not only to attract “the world’s greatest minds and best talents,” but also to lure international tourists and luxury travelers. The altogether, the cost of bringing Neom to fruition will cost an estimated $500 billion which is where most are speculating that the Saudi Aramco going public comes into play. It may be no coincidence that at the same time that construction starts on Neom, Saudi Arabia is finally set to sell shares of its national oil company, Saudi Aramco.

6Who is allowed to invest in Aramco?

Saudi citizens, GCC nationals and foreign institutional investors can participate in the IPO. Saudi family businesses and individuals have been encouraged to participate in the offering with the company promising a bonus share for every 10 shares held for 180 days, with a maximum limit of 100 shares.

7Impacts on the Saudi economy

Aramco’s IPO will likely pave the way for more “marquee privatizations”. The Aramco IPO is a key pillar of Saudi Arabia’s Vision 2030 diversification policy, which may raise as much as $200bn over the coming years. The proceeds from the IPO will be used by the kingdom’s sovereign Public Investment Fund to be re-invested into the economy. The listing could also encourage other Saudi entities to open up their books and be subject to global practices of governance.

8What could go wrong with going public

If the IPO doesn’t go very well — and there’s a distinct chance that it might not go very well — it could affect other oil companies’ earnings. Although I would say that if it doesn’t go well, that’s reflective more of the Saudi government than it is of Aramco itself. If the IPO doesn’t go very well and politically the Saudi monarchy looks bad, which could be very far-ranging, particularly for the United States, which maintains strong diplomatic ties to Saudi Arabia. So it’s something that people definitely need to be on the lookout for; this could in some ways potentially fundamentally alter the balance of power in the Middle East.

9The controversy of the sale

Politically, matters are rather complicated for Saudi Aramco right now, in light of the recent Kashoggi scandal along with the splotchy human rights record the country has. For investors elsewhere, the prospect of buying Aramco shares is complicated because the company is essentially owned by the Saudi royal family. In September, Crown Prince Mohammed belatedly acknowledges that he was accountable for the October 2018 murder of journalist Jamal Khashoggi because it happened under his watch, although he did not accept responsibility. Along with that, there’s Aramco’s environmental record which proves the company is responsible for 4.38% of the world’s carbon emissions since 1965. With all that in mind, some investors may not want their pension funds to buy shares of Aramco stock.

10Should you invest?

Despite the major move, this is, Aramco may have a hard time convincing foreign investors to look past some of the significant drawbacks. For one, shares will only be available to buy on the Tadawul in Riyadh for now. Secondly, the public float will be in the neighborhood of 2 percent of shares, making this a relatively small public debut for such a massive company. Depending on the company’s final valuation, and depending on the percent of shares it ends up listing, Aramco could end up making between $30 billion and $51 billion in this round of fundraising. The rest of the shares will be owned, of course, by the crown prince and the House of Saud which is an absolute monarchy after all, and so global investors should not expect to have any shareholder rights. Aramco’s board of directors will have a fiduciary duty not to investors but to MBS and any future monarch which has serious implications. In the past, the monarchy has used Aramco as a piggy bank, dipping into its vast coffers to finance any number of pursuits and projects. The money raised from the Aramco IPO, and any subsequent offerings, will not go to the company but will go to Saudi Arabia—to the king and his government. And every subsequent purchase of Aramco shares will raise the value of the company just a little, further enriching the king.

Thus lies the story of the most profitable company in the world as it paves the way to further fortunes by going public. Will Neom become the first futuristic city? Stay tuned to hear more.